Challenge

Republic of Panama

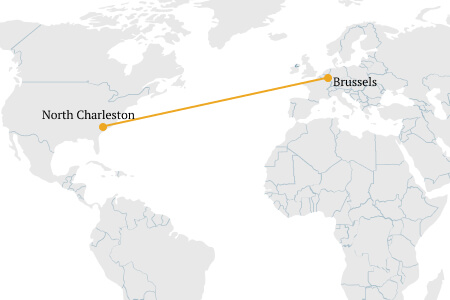

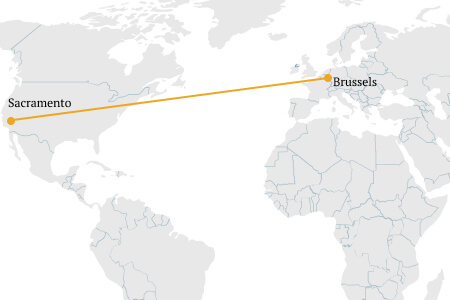

Alber & Geiger represented Panama in the aftermath of the “Panama papers” with regard to the new EU anti money laundering blacklist. As a result of the “Panama papers” the EU decided for the first time to set up its own blacklist. Before that, the EU would copy the international Financial Action Task Force (FATF) lists.

In Summer 2019, Panama was added to the grey list of FATF, at a time when the country was finalizing its reforms. Alber & Geiger was called to halt the result in FATF from spilling over in the EU and to weigh in the new EU methodology and the procedural gaps in the EU listing. Panama was caught in a timing paradox: Its automatic EU listing would be followed by a potential delisting from FATF, without clear assurances that the latter would be reflected in an EU delisting.

Strategy

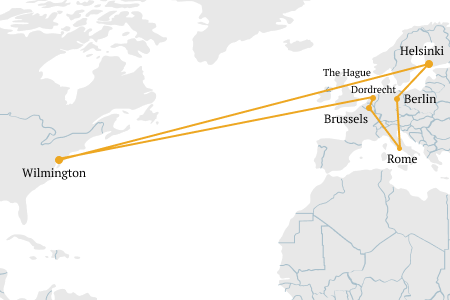

Our goal was straightforward: raise awareness for Panama’s advances in combating money laundering and through that ensure that the EU will not unjustly list Panama as a high risk third country. Our message had to circle in the three key EU institutions. The architect of the procedure and list of high risk third countries, the European Commission, and the gatekeepers of the procedure, the European Parliament and the Member States. Our message was tailor made for each front, appealing the several working levels and directorates of the Commission, the Committees of the European Parliament and different levels of organization in the Member States. Alber & Geiger grasped the opportunity of the drafting of the new methodology for the EU listing of high risk third countries, to engage with the different Commission directorates involved in the process and apply Panama’s position. In the Parliament, we focused on rewarding a third country such as Panama, which is determined to turn a bad precedent into a success story and we stressed upon the bilateral relationships of Panama towards the Member States.

Our goal was straightforward: raise awareness for Panama’s advances in combating money laundering and through that ensure that the EU will not unjustly list Panama as a high risk third country. Our message had to circle in the three key EU institutions. The architect of the procedure and list of high risk third countries, the European Commission, and the gatekeepers of the procedure, the European Parliament and the Member States. Our message was tailor made for each front, appealing the several working levels and directorates of the Commission, the Committees of the European Parliament and different levels of organization in the Member States. Alber & Geiger grasped the opportunity of the drafting of the new methodology for the EU listing of high risk third countries, to engage with the different Commission directorates involved in the process and apply Panama’s position. In the Parliament, we focused on rewarding a third country such as Panama, which is determined to turn a bad precedent into a success story and we stressed upon the bilateral relationships of Panama towards the Member States.

Results

The EU did not implement its list and methodology as planned. Panama being listed by the EU as a high risk third country within the EU anti money laundering framework now is based on an automatic listing/delisting process with FATF. Our lobbying efforts enhanced the visibility and acknowledgement of Panama’s efforts in modernizing its anti-money laundering regime and changed the original EU methodology draft according to the demands of Panama.

Our team engaged in a multifaceted approach to safeguard the interests of the medicinal and medical devices. We provided strategic input during the consultation period with the European Chemicals Agency (ECHA), highlighting the unique needs and safety considerations of specific medical devices. This was followed by an extensive outreach to stakeholders within the European Parliament, the European Commission, and the EU member states. Our efforts focused on educating decision-makers about the indispensable role of PFAS in medicinal products and medical devices and the potential supply chain risks posed by a PFAS ban.

Our team engaged in a multifaceted approach to safeguard the interests of the medicinal and medical devices. We provided strategic input during the consultation period with the European Chemicals Agency (ECHA), highlighting the unique needs and safety considerations of specific medical devices. This was followed by an extensive outreach to stakeholders within the European Parliament, the European Commission, and the EU member states. Our efforts focused on educating decision-makers about the indispensable role of PFAS in medicinal products and medical devices and the potential supply chain risks posed by a PFAS ban.

Our team embarked on a comprehensive campaign with EU lawmakers addressed their concerns. We turned the focus on India’s growing economic, technological and geopolitical role and emphasized the untapped potential for bilateral relations. By providing factual evidence and a clearer understanding over the expressed concerns, we were able to switch the focus towards the bilateral opportunities and fostering trade relations via a free trade agreement.

Our team embarked on a comprehensive campaign with EU lawmakers addressed their concerns. We turned the focus on India’s growing economic, technological and geopolitical role and emphasized the untapped potential for bilateral relations. By providing factual evidence and a clearer understanding over the expressed concerns, we were able to switch the focus towards the bilateral opportunities and fostering trade relations via a free trade agreement.  We brought together other industry players and leading associations to form a strong coalition of like-minded players to show that the issue was beyond one single company. Through our engagement we made sure that the cascading use principle is now in the language of the Renewable Energy Directive.

We brought together other industry players and leading associations to form a strong coalition of like-minded players to show that the issue was beyond one single company. Through our engagement we made sure that the cascading use principle is now in the language of the Renewable Energy Directive. We were able to garner support for higher e-fuels quotas and shepherd the uptake of e-fuels in key modes of transportation. Alber & Geiger’s effort led to a plenary vote in the European Parliament that supported higher targets for e-fuels. In a politically arena with various alternative fuels competing for incentives, our team was able to obtain clear and strong support for e-fuels, turning Europe into one of the most attractive and important markets for that.

We were able to garner support for higher e-fuels quotas and shepherd the uptake of e-fuels in key modes of transportation. Alber & Geiger’s effort led to a plenary vote in the European Parliament that supported higher targets for e-fuels. In a politically arena with various alternative fuels competing for incentives, our team was able to obtain clear and strong support for e-fuels, turning Europe into one of the most attractive and important markets for that. Our team was able to raise awareness of the situation on currency exchange services, informing officials and politicians on the differences between the model offered by the credit cards, and that offered by the DCC providers, putting the emphasis on the DCC currency exchange service that brings more transparency and consumer choice. Simultaneously, through regular exchanges with lawmakers we have laid the foundation for support for our amendments on the ongoing EU legislation on the cross border payment regulation and the payment service directive. Finally, we managed to shift alliances in support of the issues highlighted by DCC providers.

Our team was able to raise awareness of the situation on currency exchange services, informing officials and politicians on the differences between the model offered by the credit cards, and that offered by the DCC providers, putting the emphasis on the DCC currency exchange service that brings more transparency and consumer choice. Simultaneously, through regular exchanges with lawmakers we have laid the foundation for support for our amendments on the ongoing EU legislation on the cross border payment regulation and the payment service directive. Finally, we managed to shift alliances in support of the issues highlighted by DCC providers.  We were able – in a short period of time – to devise a strategy that put the spotlight on the necessity of Mancozeb and lack of efficient alternatives. We also helped put together evidence on the safety of the continued use of Mancozeb in bananas owing to the characteristics of bananas, and no associated dietary and health risks. Finally, our team brought to the attention of decision-makers trade and development arguments that emphasized further the importance of a balanced decision.

We were able – in a short period of time – to devise a strategy that put the spotlight on the necessity of Mancozeb and lack of efficient alternatives. We also helped put together evidence on the safety of the continued use of Mancozeb in bananas owing to the characteristics of bananas, and no associated dietary and health risks. Finally, our team brought to the attention of decision-makers trade and development arguments that emphasized further the importance of a balanced decision.

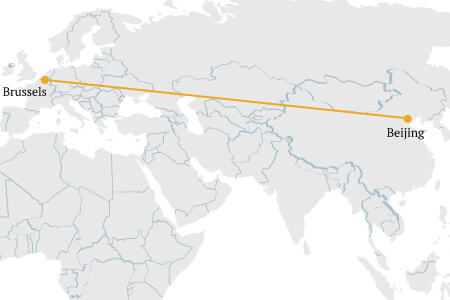

Alber & Geiger engaged on a plethora of issues, including EU-China relations, cybersecurity, right to repair, cyber resilience act, corporate sustainable due diligence, sanctions as well as the digital markets act, by providing high-end analysis and advise on content and engagement with the European Institutions, including the European Parliament and the European Commission. We also helped compile language to assist Xiaomi in addressing European Parliament concerns on the need to protect consumers from Chinese mobile phones by highlighting Xiaomi adherence to EU GDPR standards and norms.

Alber & Geiger engaged on a plethora of issues, including EU-China relations, cybersecurity, right to repair, cyber resilience act, corporate sustainable due diligence, sanctions as well as the digital markets act, by providing high-end analysis and advise on content and engagement with the European Institutions, including the European Parliament and the European Commission. We also helped compile language to assist Xiaomi in addressing European Parliament concerns on the need to protect consumers from Chinese mobile phones by highlighting Xiaomi adherence to EU GDPR standards and norms.

On a first stage, Alber & Geiger supported a draft legislation which was in favor of our client’s expectations. On a second stage, our team also saw through the clearance of the German legislation from the EU Commission and inspire other Member States follow the German path. Finally, we locked the support from the German upper house and rapporteurs of the lower house, succeeding in the eventual speedy adoption of the legislation, which will be hopefully used as a blueprint solution in the EU.

On a first stage, Alber & Geiger supported a draft legislation which was in favor of our client’s expectations. On a second stage, our team also saw through the clearance of the German legislation from the EU Commission and inspire other Member States follow the German path. Finally, we locked the support from the German upper house and rapporteurs of the lower house, succeeding in the eventual speedy adoption of the legislation, which will be hopefully used as a blueprint solution in the EU.

Our goal was straightforward: raise awareness for Panama’s advances in combating money laundering and through that ensure that the EU will not unjustly list Panama as a high risk third country. Our message had to circle in the three key EU institutions. The architect of the procedure and list of high risk third countries, the European Commission, and the gatekeepers of the procedure, the European Parliament and the Member States. Our message was tailor made for each front, appealing the several working levels and directorates of the Commission, the Committees of the European Parliament and different levels of organization in the Member States. Alber & Geiger grasped the opportunity of the drafting of the new methodology for the EU listing of high risk third countries, to engage with the different Commission directorates involved in the process and apply Panama’s position. In the Parliament, we focused on rewarding a third country such as Panama, which is determined to turn a bad precedent into a success story and we stressed upon the bilateral relationships of Panama towards the Member States.

Our goal was straightforward: raise awareness for Panama’s advances in combating money laundering and through that ensure that the EU will not unjustly list Panama as a high risk third country. Our message had to circle in the three key EU institutions. The architect of the procedure and list of high risk third countries, the European Commission, and the gatekeepers of the procedure, the European Parliament and the Member States. Our message was tailor made for each front, appealing the several working levels and directorates of the Commission, the Committees of the European Parliament and different levels of organization in the Member States. Alber & Geiger grasped the opportunity of the drafting of the new methodology for the EU listing of high risk third countries, to engage with the different Commission directorates involved in the process and apply Panama’s position. In the Parliament, we focused on rewarding a third country such as Panama, which is determined to turn a bad precedent into a success story and we stressed upon the bilateral relationships of Panama towards the Member States.