On March 10, the Commission presented its Industrial Policy Strategy. This plan sets out a broad work programme: from the implementation of a digital industrial strategy to the revision of competition rules. This strategy plans for a strengthening of the fight against barriers to trade within the internal market, development plans for key sectors and a strengthened partnership with industry in policy making. In addition, the Commission plans to internationalise its standards, in particular through WTO negotiations. Therefore, all companies, even those that do not trade directly with the EU, are concerned by this action plan.

On March 10, the Commission presented its Industrial Policy Strategy. This plan sets out a broad work programme: from the implementation of a digital industrial strategy to the revision of competition rules. This strategy plans for a strengthening of the fight against barriers to trade within the internal market, development plans for key sectors and a strengthened partnership with industry in policy making. In addition, the Commission plans to internationalise its standards, in particular through WTO negotiations. Therefore, all companies, even those that do not trade directly with the EU, are concerned by this action plan.

More concretely, the plan provides for the modernisation of the Internal Market. The Commission plans to set up a Single Market Enforcement Task Force, a review of intellectual property rules and a recasting of the competition and anti-trust rules. In addition, the Commission will, in the coming months, present its strategies sector by sector. This concerns in particular the chemical sector and the mobility sector. The Commission will build its strategies and priorities through co-decision via the Industrial Forum and by fostering public-private partnerships.

In conclusion, the internal market will be strengthened, and structuring rules will be reviewed in the coming months. In addition, sector-by-sector industrial strategies will have an impact on product design and on research and innovation through funding programmes and industrial alliances supported by public actors. As the Commission has announced that these regulations will be co-designed in consultation with industry representatives, it is crucial for industry to strengthen its presence in the European decision-making process.

The European Green Deal, proposed by President von der Leyen to be delivered in the initial 100 days in office, will include the first European Climate Law enshrining the 2050 climate-neutrality target into legislation. The Green Deal will include a more inclusive Emissions Trading System (ETS), as well as a Carbon Border Tax to mitigate ETS’s effects on the market.

The European Green Deal, proposed by President von der Leyen to be delivered in the initial 100 days in office, will include the first European Climate Law enshrining the 2050 climate-neutrality target into legislation. The Green Deal will include a more inclusive Emissions Trading System (ETS), as well as a Carbon Border Tax to mitigate ETS’s effects on the market. The European Payments Service Directive II (PSD2), in force since January 2018, is currently stirring debate among Member States regarding the process of its implementation. The Directive is designed to harmonize and simplify money transfers inside the EU, decrease fraud in online payments, and inform consumers about the rights and obligations.

The European Payments Service Directive II (PSD2), in force since January 2018, is currently stirring debate among Member States regarding the process of its implementation. The Directive is designed to harmonize and simplify money transfers inside the EU, decrease fraud in online payments, and inform consumers about the rights and obligations. European legislation restricting the use of hazardous substances (RoHS) in electrical and electronic equipment was approved in 2003 and has since been reviewed in 2011 and 2017. The European Commission initiated in September a consultation to collect public and business’ opinions in order to assess the performance of the restriction of hazardous elements, the management of chemical waste and the impact of these materials on human and environmental health. Currently the use of lead, mercury, cadmium, hexavalent chromium, PBB and PBDE in electrical and electronic equipment is restricted. Four phthalates were recently added to this list in July 2019.

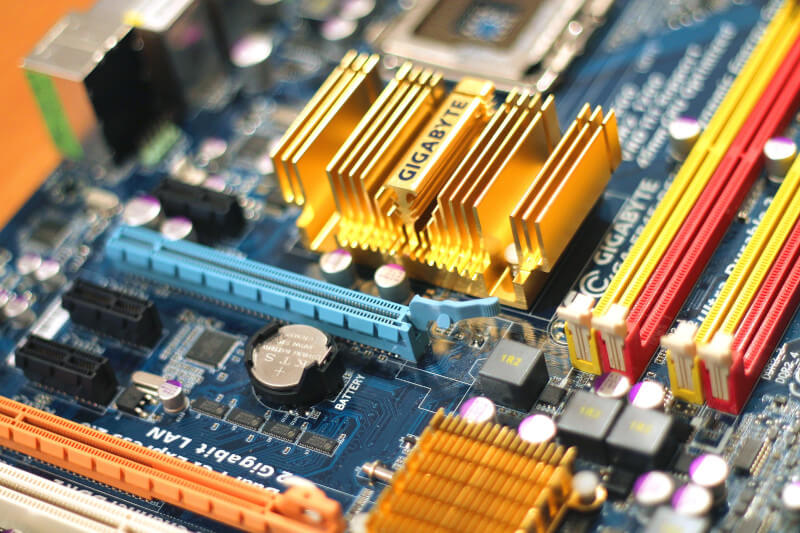

European legislation restricting the use of hazardous substances (RoHS) in electrical and electronic equipment was approved in 2003 and has since been reviewed in 2011 and 2017. The European Commission initiated in September a consultation to collect public and business’ opinions in order to assess the performance of the restriction of hazardous elements, the management of chemical waste and the impact of these materials on human and environmental health. Currently the use of lead, mercury, cadmium, hexavalent chromium, PBB and PBDE in electrical and electronic equipment is restricted. Four phthalates were recently added to this list in July 2019. The European Commission has launched a public consultation to gather stakeholder and the public’s opinion on the scope and application of the future EU harmonized rules on voice call termination services. A termination rate is one component in the cost calculation for providing telephone service and is subject to most variation in the EU.

The European Commission has launched a public consultation to gather stakeholder and the public’s opinion on the scope and application of the future EU harmonized rules on voice call termination services. A termination rate is one component in the cost calculation for providing telephone service and is subject to most variation in the EU. As a result of the manipulation of two prominent benchmarks – the London Interbank Offered Rate (LIBOR) and the Euro Interbank Offered Rate (EURIBOR) – the EU adopted the Benchmark Regulation (BMR) on indices used in financial instruments and contracts or to measure the performance of investment funds in January 2018. The European Commission has initiated a consultation on the review of the BMR, two years after its entry into force to collect stakeholders’ opinions on benchmarks’ efficiency.

As a result of the manipulation of two prominent benchmarks – the London Interbank Offered Rate (LIBOR) and the Euro Interbank Offered Rate (EURIBOR) – the EU adopted the Benchmark Regulation (BMR) on indices used in financial instruments and contracts or to measure the performance of investment funds in January 2018. The European Commission has initiated a consultation on the review of the BMR, two years after its entry into force to collect stakeholders’ opinions on benchmarks’ efficiency. The European Commission released a new communication, guiding the participation of third country bidders and goods in the EU procurement market. The document aims to foment competition in public tenders and provide information to public buyers in Member States. The document advises on quality standards, how to assess abnormally low-priced offers and compliance with social and environmental obligations.

The European Commission released a new communication, guiding the participation of third country bidders and goods in the EU procurement market. The document aims to foment competition in public tenders and provide information to public buyers in Member States. The document advises on quality standards, how to assess abnormally low-priced offers and compliance with social and environmental obligations. In April this year, the European Commission put forward an EU approach to artificial intelligence and robotics. The EU’s plans include funding to encourage the uptake between public and private sectors. Moreover, the EU’s approach foresees support to education and labour to prepare for the deployment of AI. Last, while the EU is determined to stay at the front of this technological development, it will also work on ensuring a proper legal and ethical framework.

In April this year, the European Commission put forward an EU approach to artificial intelligence and robotics. The EU’s plans include funding to encourage the uptake between public and private sectors. Moreover, the EU’s approach foresees support to education and labour to prepare for the deployment of AI. Last, while the EU is determined to stay at the front of this technological development, it will also work on ensuring a proper legal and ethical framework. After the failure of the negotiations with the industry for a new Memorandum of Understanding to harmonise chargers for data-enabled mobiles sold in the EU, the European Commission has initiated in May 2019 a public consultation to collect stakeholders’ opinions in order to find the best solution to the problem of fragmentation of the charging solutions.

After the failure of the negotiations with the industry for a new Memorandum of Understanding to harmonise chargers for data-enabled mobiles sold in the EU, the European Commission has initiated in May 2019 a public consultation to collect stakeholders’ opinions in order to find the best solution to the problem of fragmentation of the charging solutions. The European Union has picked up President Donald Trump’s tariffs challenge and is considering responding with trade countermeasures. The WTO rules afford its members the possibility to impose temporary levies as safeguard. At the same time, it allows its members to retaliate proportionately in case the new trade restrictions are not adequately compensated within 90 days.

The European Union has picked up President Donald Trump’s tariffs challenge and is considering responding with trade countermeasures. The WTO rules afford its members the possibility to impose temporary levies as safeguard. At the same time, it allows its members to retaliate proportionately in case the new trade restrictions are not adequately compensated within 90 days.