The European Green Deal, proposed by President von der Leyen to be delivered in the initial 100 days in office, will include the first European Climate Law enshrining the 2050 climate-neutrality target into legislation. The Green Deal will include a more inclusive Emissions Trading System (ETS), as well as a Carbon Border Tax to mitigate ETS’s effects on the market.

The European Green Deal, proposed by President von der Leyen to be delivered in the initial 100 days in office, will include the first European Climate Law enshrining the 2050 climate-neutrality target into legislation. The Green Deal will include a more inclusive Emissions Trading System (ETS), as well as a Carbon Border Tax to mitigate ETS’s effects on the market.

An extension of the ETS in the airlines sector will be translated to increased costs for the industry and additional taxes. The adjustment tax is yet to be formally proposed, but it aims to prevent businesses from relocating to laxer jurisdictions, creating ‘carbon leakage’, and to protect them from non-EU competitors.

The additional tax-burdens are met with criticism due to their incompatibility to WTO rules and the distortion of the level-playing field. If not applied unanimously with European unilateral backing, the tax adjustment risks high costs for businesses and consumers. Additionally, sectors with a high degree of cross-border division of labour or a global supply chain will be most heavily affected. Ramifications of the supposed tax were also felt in wider sectors outside the energy industry, as the levy is feared to worsen trade relations with the US, causing increased tariffs on EU products.

The European Payments Service Directive II (PSD2), in force since January 2018, is currently stirring debate among Member States regarding the process of its implementation. The Directive is designed to harmonize and simplify money transfers inside the EU, decrease fraud in online payments, and inform consumers about the rights and obligations.

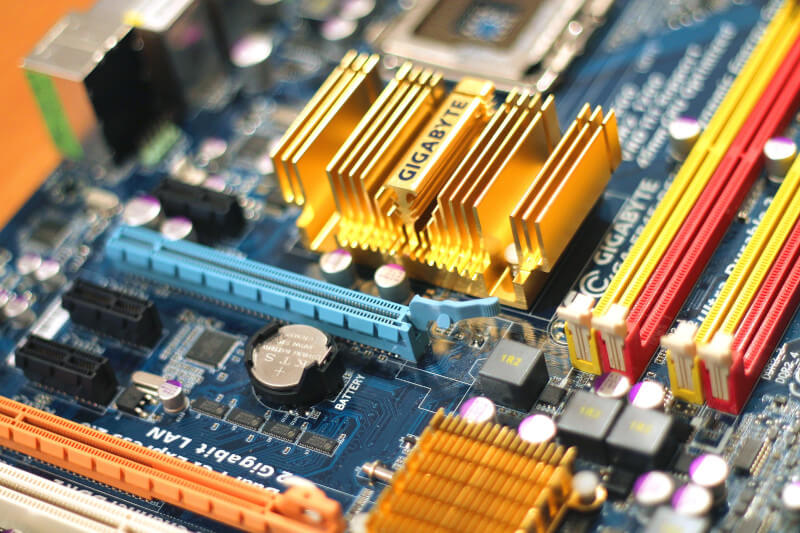

The European Payments Service Directive II (PSD2), in force since January 2018, is currently stirring debate among Member States regarding the process of its implementation. The Directive is designed to harmonize and simplify money transfers inside the EU, decrease fraud in online payments, and inform consumers about the rights and obligations. European legislation restricting the use of hazardous substances (RoHS) in electrical and electronic equipment was approved in 2003 and has since been reviewed in 2011 and 2017. The European Commission initiated in September a consultation to collect public and business’ opinions in order to assess the performance of the restriction of hazardous elements, the management of chemical waste and the impact of these materials on human and environmental health. Currently the use of lead, mercury, cadmium, hexavalent chromium, PBB and PBDE in electrical and electronic equipment is restricted. Four phthalates were recently added to this list in July 2019.

European legislation restricting the use of hazardous substances (RoHS) in electrical and electronic equipment was approved in 2003 and has since been reviewed in 2011 and 2017. The European Commission initiated in September a consultation to collect public and business’ opinions in order to assess the performance of the restriction of hazardous elements, the management of chemical waste and the impact of these materials on human and environmental health. Currently the use of lead, mercury, cadmium, hexavalent chromium, PBB and PBDE in electrical and electronic equipment is restricted. Four phthalates were recently added to this list in July 2019. The European Commission has launched a public consultation to gather stakeholder and the public’s opinion on the scope and application of the future EU harmonized rules on voice call termination services. A termination rate is one component in the cost calculation for providing telephone service and is subject to most variation in the EU.

The European Commission has launched a public consultation to gather stakeholder and the public’s opinion on the scope and application of the future EU harmonized rules on voice call termination services. A termination rate is one component in the cost calculation for providing telephone service and is subject to most variation in the EU. As a result of the manipulation of two prominent benchmarks – the London Interbank Offered Rate (LIBOR) and the Euro Interbank Offered Rate (EURIBOR) – the EU adopted the Benchmark Regulation (BMR) on indices used in financial instruments and contracts or to measure the performance of investment funds in January 2018. The European Commission has initiated a consultation on the review of the BMR, two years after its entry into force to collect stakeholders’ opinions on benchmarks’ efficiency.

As a result of the manipulation of two prominent benchmarks – the London Interbank Offered Rate (LIBOR) and the Euro Interbank Offered Rate (EURIBOR) – the EU adopted the Benchmark Regulation (BMR) on indices used in financial instruments and contracts or to measure the performance of investment funds in January 2018. The European Commission has initiated a consultation on the review of the BMR, two years after its entry into force to collect stakeholders’ opinions on benchmarks’ efficiency. The European Commission released a new communication, guiding the participation of third country bidders and goods in the EU procurement market. The document aims to foment competition in public tenders and provide information to public buyers in Member States. The document advises on quality standards, how to assess abnormally low-priced offers and compliance with social and environmental obligations.

The European Commission released a new communication, guiding the participation of third country bidders and goods in the EU procurement market. The document aims to foment competition in public tenders and provide information to public buyers in Member States. The document advises on quality standards, how to assess abnormally low-priced offers and compliance with social and environmental obligations.